NEW YORK, Jan. 31, 2026

Bitcoin’s hashrate fell about 12% since Nov. 11, 2025 and then plunged 30–40% in a storm-driven shock around Jan. 23–26, slowing block times to as much as about 14.7 minutes, in the latest sign that Bitcoin’s mining footprint is increasingly exposed to localized U.S. power disruptions.

The move reflected miners going offline, some involuntarily because of outages and some voluntarily because extreme power prices and grid stress can make mining unprofitable or politically risky during emergencies.

Bitcoin hashrate drop hits miners as winter storm disrupts U.S. power

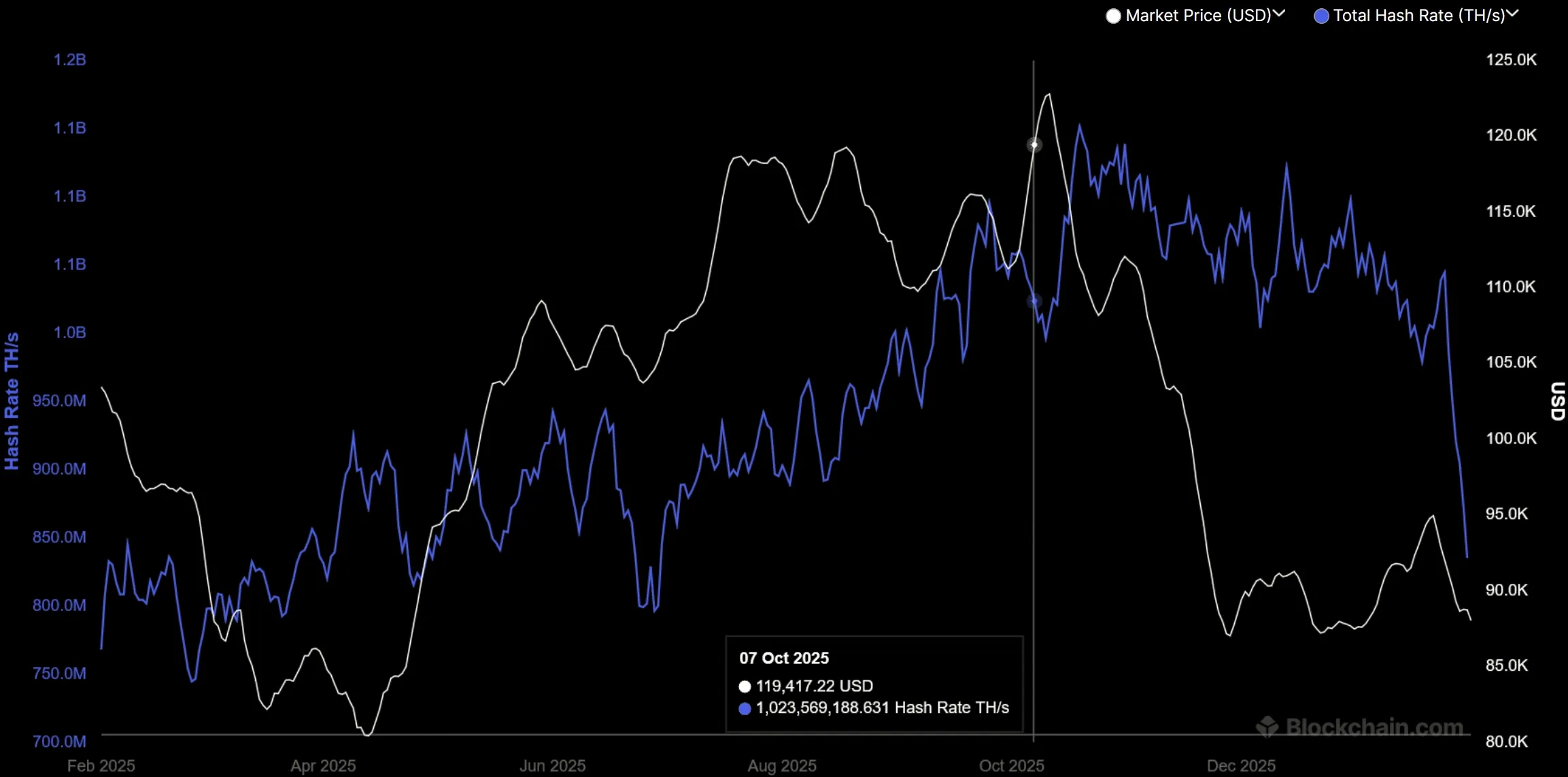

Market snapshot: Hashrate chart described a roughly 12% drawdown in total network hashrate since Nov. 11, 2025, with readings near 970 EH/s, while the acute plunge in late January pulled estimates down toward the mid-600 EH/s range for several days. CoinWarz’ hashrate chart tracked a similar trough around 663–690 EH/s, and CoinMarketCap tied the move to a severe U.S. winter storm that hit mining-heavy regions.

Bitcoin’s price action compounded the stress. The storm hit amid a broader BTC correction from prior highs into the $80,000–$90,000 range, keeping margins thin for higher-cost miners and raising the probability of “capitulation” behavior, with miners selling reserves or shutting down older machines when profitability dips.

Hashrate estimates dropped sharply around Jan. 23–26, 2026 amid a winter-storm disruption.

For non-technical readers, hashrate is a proxy for how much computing power is competing to mine bitcoin. It is commonly measured in exahashes per second (EH/s); some dashboards use zettahashes (ZH/s), where 1 ZH/s equals 1,000 EH/s.

Bitcoin also slid over the past month. CoinGecko’s daily data showed BTC falling from about $88,728 on Jan. 2 to about $78,241 on Jan. 31, a drop of roughly 12% over the window.

During the sharpest part of the storm window, market commentary described a two-to-three day drop from peaks near about 1.13 ZH/s (roughly 1,130 EH/s) to lows around 663–690 EH/s. Estimates later recovered toward roughly 850–970 EH/s as miners came back online.

Bitcoin hashrate dashboard showed the network trending lower from November into January before the sharper late-January air pocket, the fastest part of the decline being over a two to three day window. Those dashboards do not identify which miners went offline, and the geographic split of the outage impact was not immediately clear.

Foundry USA disruptions slow block times and pressure mining revenue

The most visible operational impact is time: when a large chunk of hashrate disappears, blocks typically arrive more slowly until the difficulty adjustment catches up. During the late-January plunge, reports said average block times stretched into the 12–14.7 minute range, a temporary slowdown that can ripple into exchange settlement flows and user confirmation times.

The storm has been referred to in some market chatter as “Winter Storm Fernan,” though it was not immediately clear whether that label reflected an official meteorological designation or a trader shorthand for the event.

Some analysts pointed to pool-level dislocations as a clue that the shock was heavily U.S.-centric. Foundry USA Pool, one of the largest pools by share, was cited as losing up to roughly 60% of its hashrate, with estimates putting about 200 EH/s offline at the worst point. The pool has not published a detailed breakdown of the outage causes, and it was not immediately clear which of its mining clients were most affected.

U.S.-based miners have become a bigger share of the network since 2021, and analysts often estimate the U.S. hosts 30% or more of global capacity. That concentration can increase sensitivity to regional weather and electricity market dynamics when large users curtail load.

Revenue also moved quickly. Estimates cited in market commentary put daily mining revenue falling from about $45 million to about $28 million at the low, reflecting slower blocks, reduced production, and a market environment where fees can be volatile. Those figures vary by data source and methodology, and the exact split between subsidy and fees during the shock was not immediately clear.

This kind of episode can coincide with “fear” narratives that dominate timelines. We recently covered the broader liquidation-driven risk-off move in Bitcoin Is Cheaper, Not Broken, as a Fear Gauge Sinks to 16, a reminder that mining stress and market stress can arrive in the same week for different reasons.

A hashrate “crash” echoes China’s 2021 mining ban, but the mechanics differ

The late-January slide was the largest sustained hashrate decline since China’s 2021 mining ban, which forced miners to relocate and pushed the network through a far steeper 50%+ drawdown over months. This time, the immediate driver was physical: weather, grid strain, and curtailments, rather than a legal ban.

Still, the comparison matters because the network’s response is mechanical. When hashrate falls, the protocol’s difficulty adjustment should eventually drop, raising the expected bitcoin output for miners who remain online and helping normalize block timing. That dynamic is one reason “miner capitulation” signals, like hash-ribbon style indicators, are sometimes treated as markers of stress rather than proof of a broken network.

In the short run, the disruption can push confirmation times longer and create bursty fee conditions. Over a longer window, the protocol is designed to adapt, but the episode underscored that operational shocks can arrive suddenly.

What remains unclear is how much of the decline is truly weather-driven versus structural. Commentary around the episode also pointed to miner unprofitability during the BTC correction, some operators reallocating power and capex toward AI or data-center compute, and the long tail of post-2021 geographic rebalancing. Public dashboards do not provide a definitive attribution breakdown, and most miners do not disclose real-time curtailment or fleet-by-fleet utilization.

The shift toward U.S. mining concentration is also a double-edged headline: it can bring clearer regulation and grid partnerships, but it can also increase sensitivity to regional weather and electricity market dynamics. On the policy side, Washington’s crypto timeline remains unsettled, and some market participants are tracking whether legislative delays add to risk premia; see our coverage of the U.S. Senate CLARITY Act vote being canceled.

In practical terms, the storm served as a real-world stress test of how quickly hashpower can disappear and return. That is different from a slow-burn relocation shock like 2021, but it can still produce the same visible symptoms: slower blocks, miner margin compression, and a noisy debate over security.

The key watch items are the next difficulty adjustment window, the pace of hashrate normalization back toward prior highs, and whether miner revenue stabilizes as block times return closer to the protocol’s target. If grid-related curtailments become more frequent, analysts will likely focus less on one-off “crash” headlines and more on whether U.S. mining capacity is diversifying across regions to reduce single-storm exposure.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | Blockchain.com: Bitcoin hashrate chart |

| | CoinWarz: Bitcoin hashrate chart |

| | CoinMarketCap Academy: Bitcoin hash rate falls as winter storm disrupts miners |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What is Bitcoin hashrate?

Hashrate is an estimate of how much computing power miners are contributing to secure Bitcoin. Higher hashrate generally means more energy and hardware are competing to produce blocks.

Why did Bitcoin hashrate drop during the winter storm?

Mining is electricity-intensive. Power outages, grid strain, and voluntary curtailments can push miners offline quickly, reducing total network hashrate.

Does a hashrate crash mean Bitcoin is less secure?

A drop can reduce the cost to attack the network in theory, but Bitcoin’s security is still large in absolute terms and difficulty adjustments help restore normal block timing. The level of risk is not immediately clear from hashrate alone.

What happens when block times slow to 12–14 minutes?

Transactions can take longer to confirm and fee pressure can rise, especially if demand stays high. Over time, the protocol adjusts mining difficulty to target roughly 10-minute blocks.

What is a mining difficulty adjustment?

Bitcoin automatically adjusts difficulty about every 2,016 blocks so that blocks average roughly one every 10 minutes, even if hashrate changes.

What should investors watch after a hashrate shock?

Watch for hashrate normalization, the next difficulty adjustment, and whether miner revenue and on-chain fees stabilize. Macro catalysts and ETF flows can also shape risk appetite around the same time.