NEW YORK, Jan. 8, 2026 –

Morgan Stanley filed to register bitcoin, ether, and solana ETF-style trusts with U.S. regulators, as bitcoin traded near $90,700 on Thursday and markets kept tracking the next wave of crypto products in the fund wrapper.

The filings describe three separate vehicles, Morgan Stanley Bitcoin Trust, Morgan Stanley Ethereum Trust, and Morgan Stanley Solana Trust, each built to issue shares that would trade on a U.S. exchange if approved.

In the Morgan Stanley Ethereum Trust prospectus, the company said the trust aims to track ether’s performance against a pricing benchmark that was left blank in the initial filing, net of expenses, and to reflect rewards from staking a portion of the trust’s ether, according to the S-1 filing.

Pricing data showed bitcoin at about $90,725, down roughly 0.2% over 24 hours, with estimated 24-hour volume near $48.3 billion. Ether was about $3,099, down roughly 1.1%, and solana was about $137, up roughly 1.1%.

Bitcoin (BTC) - price snapshot through Jan. 8

BTC

Morgan Stanley’s Bitcoin, Ethereum, and Solana ETF filings: dates and structure

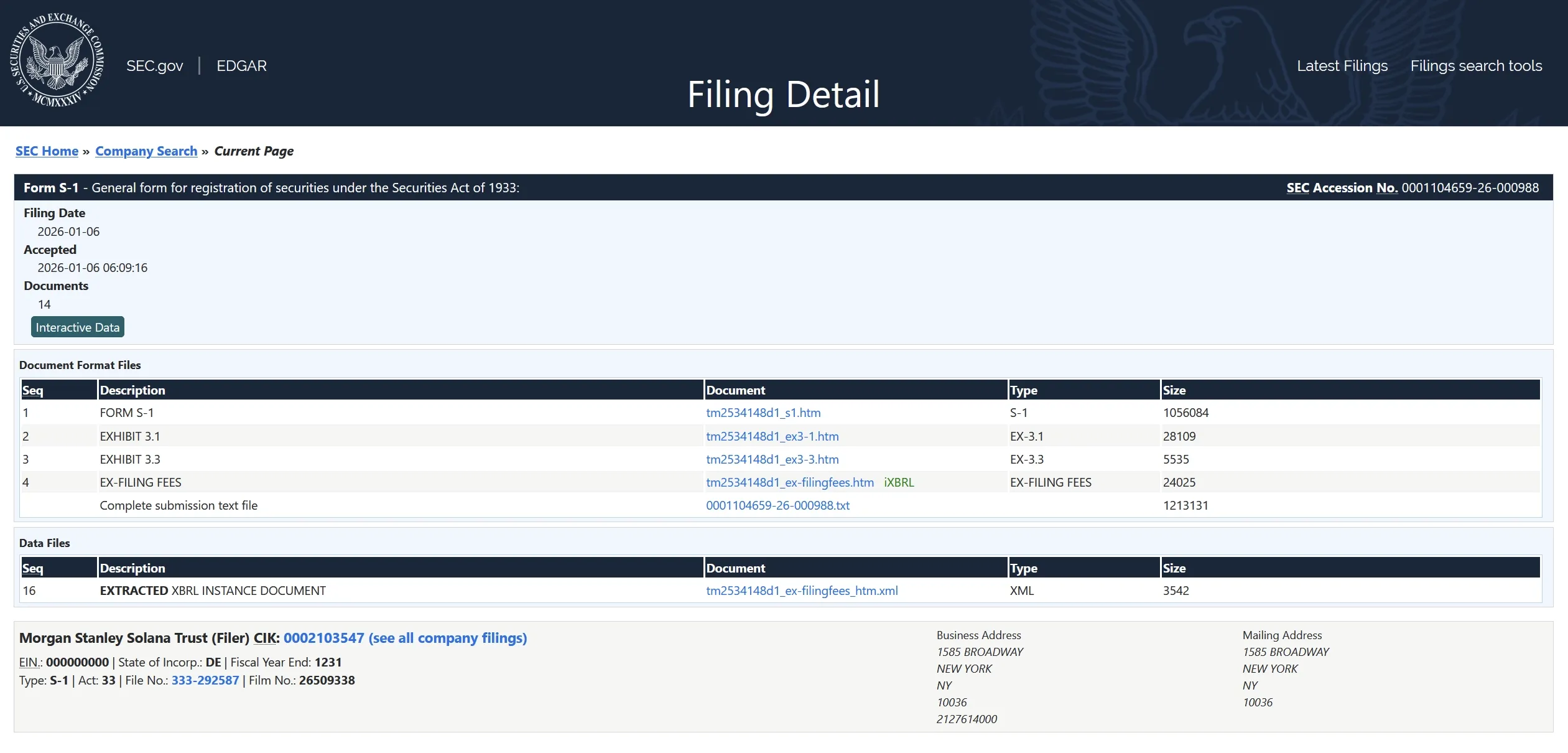

The S-1 registration statement for the bitcoin trust was filed on Jan. 6, and the solana trust filing also hit EDGAR on Jan. 6, the SEC records show. The ether trust S-1 was filed on Jan. 7, according to the ether trust’s filing index.

An S-1 is the standard form issuers use to register a new security for public sale in the U.S. For crypto ETFs, investors still watch a second track: the exchange-level rule change filing, often a 19b-4, that is part of the listing process and can shape timelines.

Many operational details in the filings were not immediately clear from the summary sections, including the specific exchange name and the benchmark provider, both shown as placeholders in the prospectus language. It was also not immediately clear when, or if, Morgan Stanley would publish a target ticker symbol.

The filings were submitted as three separate S-1 registration statements, each describing a standalone trust structure for bitcoin, ether, or solana, SEC records show.

The broader ETF backdrop has been shifting since spot bitcoin ETFs began trading in 2024 and U.S. issuers expanded the shelf of listed crypto products. In early December, Vanguard reopened access to select third-party crypto ETFs, a sign that mainstream broker plumbing is treating the ETF wrapper as the default on-ramp for directional exposure.

This week’s filings also land as lawmakers debate the next phase of U.S. crypto rules, including the market-structure framework laid out in the CLARITY Act coverage. Stablecoin rules already moved in 2025 under the GENIUS Act, and banks are fighting over where crypto rails sit in customer apps, which we broke down in Banks Are Coming for the Stablecoin Market.

The immediate signal from the documents is narrower than a policy headline. Morgan Stanley is testing whether it can package spot exposure to three large tokens into a single brand family, and whether the ether and solana funds can add staking economics without breaking the ETF model.

Ethereum and Solana ETF staking: what “staking rewards” means in an ETF

The filings describe staking as a portfolio activity, not a side product. The ether trust says it would seek to reflect “rewards from staking a portion of the Trust’s ether,” and the solana trust uses parallel language tied to staking “a portion of the Trust’s SOL,” according to the solana trust’s S-1.

That matters because staking can add two features investors do not get from a pure spot tracker.

First, it can add a yield-like return stream in the same asset, paid in ETH or SOL, with the trust disclosures framing how rewards are expected to flow into the fund’s net asset value. Second, it can add unique risks, including validator uptime risk and “slashing,” where a validator can lose staked funds after certain failures or rule violations, a concept spelled out in the prospectus language around selecting third-party staking services providers.

The filings also flag constraints that shape how staking could be used inside a regulated wrapper. The ether trust describes using third-party staking services providers and monitoring factors like “slashing history,” while also stating that the trust’s assets, including staked assets, would not serve as collateral for a loan or similar arrangement, the S-1 showed.

The ether and solana filings also describe how staking rewards could turn into real fund activity. The ether trust said it does not intend to buy or sell ether except for share creations and redemptions and for distributions made at least quarterly to distribute staking rewards, and it said the sponsor may sell ether to pay certain expenses, a filing showed.

The solana trust uses parallel language on quarterly distributions tied to staking rewards and notes the sponsor may sell SOL to cover some costs, according to its prospectus. For investors, that means staking is linked to fund plumbing like fees and cash distributions, not just long-term compounding.

What comes next: SEC review, exchange filings, and market focus

The next checkpoints are procedural. Investors will watch for exchange listing filings tied to the trusts, SEC staff comment letters on the registration statements, and whether the placeholder fields in the prospectuses get filled in with named exchanges, benchmark providers, and service vendors.

Another near-term tell will be how large broker platforms and wealth managers message “staking rewards” inside a fund wrapper, since staking adds a second driver of returns that can be misunderstood by investors who only want price exposure. In parallel, advisors are still digesting how much crypto exposure belongs in a portfolio at all, a question that surfaced in December after Reuters reported Bank of America expanded crypto access for wealth management clients.

For now, the unknowns are as important as the filings themselves: whether the SEC will accept staking-based mechanics in an exchange-traded structure, what fees the trusts would charge, and which service providers would sit between fund shareholders and on-chain staking. The next concrete updates should come through EDGAR amendments, listing paperwork, and the first disclosures that show how these products would handle custody, staking operations, and daily pricing.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

Did Morgan Stanley file for a bitcoin ETF, an ethereum ETF, and a solana ETF?

Yes. Morgan Stanley filed separate S-1 registration statements for Morgan Stanley Bitcoin Trust, Morgan Stanley Ethereum Trust, and Morgan Stanley Solana Trust, SEC records show.

When did Morgan Stanley file the crypto ETF S-1s?

The SEC filing indexes show the bitcoin trust and solana trust S-1s filed on Jan. 6, 2026, and the ethereum trust S-1 filed on Jan. 7, 2026.

Are these spot crypto ETFs or something else?

The documents describe exchange-traded trusts designed to hold the tokens and issue shares that would trade on a U.S. exchange if approved. The specific exchange and pricing benchmark details were left blank in the initial filings.

Do the Morgan Stanley ethereum and solana ETF filings include staking rewards?

The ethereum and solana S-1s describe tracking the token’s price net of expenses and reflecting rewards from staking a portion of the trust’s holdings, according to the prospectus language.

What is staking in ethereum and solana, in plain English?

Staking is when a proof-of-stake network locks tokens to help secure the blockchain and pays rewards in the same token. Those rewards can vary with network conditions and come with risks like validator downtime and slashing.

What happens after an S-1 filing for a crypto ETF?

The SEC can review and comment on the registration statement, and the exchange typically must complete its own listing process through a rule change filing often referred to as a 19b-4. Timing for approvals was not disclosed.

Will an ethereum or solana ETF with staking pay out staking rewards?

The S-1s describe reflecting staking rewards, and the prospectuses discuss distributions tied to staking rewards, including language about quarterly timing. The amount and mechanics for any payouts were not immediately clear from the high-level filing summaries.