SEOUL, Jan. 12, 2026 -

South Korea’s Financial Services Commission is drafting guidelines that would let listed firms and professional investors buy crypto again, capped at 5% of equity and limited to the top 20 tokens, according to a Jan. 12 report from Seoul Economic Daily.

The proposal would mark a practical widening of access for corporate balance sheets in one of the world’s largest economies, after banks effectively stopped issuing corporate real-name accounts for exchange trading during the government’s late-2017 crackdown on crypto speculation.

Market snapshot: bitcoin and ether were modestly higher

Market data showed bitcoin at about $91,647, up about 1.6% over 8 hours as of 16:01 UTC on Jan. 12, while ether traded near $3,128, up about 0.4%. Total crypto market value was about $3.21 trillion, up about 0.4% over 24 hours, with bitcoin dominance near 57%.

Bitcoin (BTC) - 8-hour price snapshot

BTC

What South Korea’s FSC guidelines would allow, and what they would restrict

The draft framework would allow eligible firms to allocate up to 5% of their equity capital annually, limited to the top 20 cryptocurrencies by market capitalization listed on the country’s major exchanges, with the change expected to take effect later in 2026 (crypto.news).

In a February 2025 government roadmap, the FSC described the late-2017 policy response as cutting off corporate participation by restricting banks from issuing corporate real-name accounts for exchange trading and by barring regulated financial firms from holding or buying crypto, framing the rules as a way to contain speculation and money-laundering risks (FSC, roadmap PDF).

That same FSC roadmap sketched a phased approach for opening access, including a stage aimed at listed companies and corporate professional investors. The document described the target pool as about 2,500 listed firms plus about 1,000 corporate entities registered as professional investors under the Capital Markets Act, and it defined corporate professional investors as firms with financial investment product balances of at least 10 billion won, or 5 billion won for firms subject to external audit requirements.

Context: from a 2017 clampdown to a staged reopening

The core change is not about retail access. It is about whether corporates can move from indirect exposure, like equity stakes in crypto-linked companies, toward direct balance-sheet positions in spot tokens under bank and exchange controls.

A key gating item is the corporate real-name account. In South Korea’s exchange market structure, banks issue accounts tied to verified identities, and those accounts are used to connect fiat rails to exchange trading. When banks stop issuing these accounts to corporate entities, a large part of the market becomes blocked even if no statute explicitly bans trading.

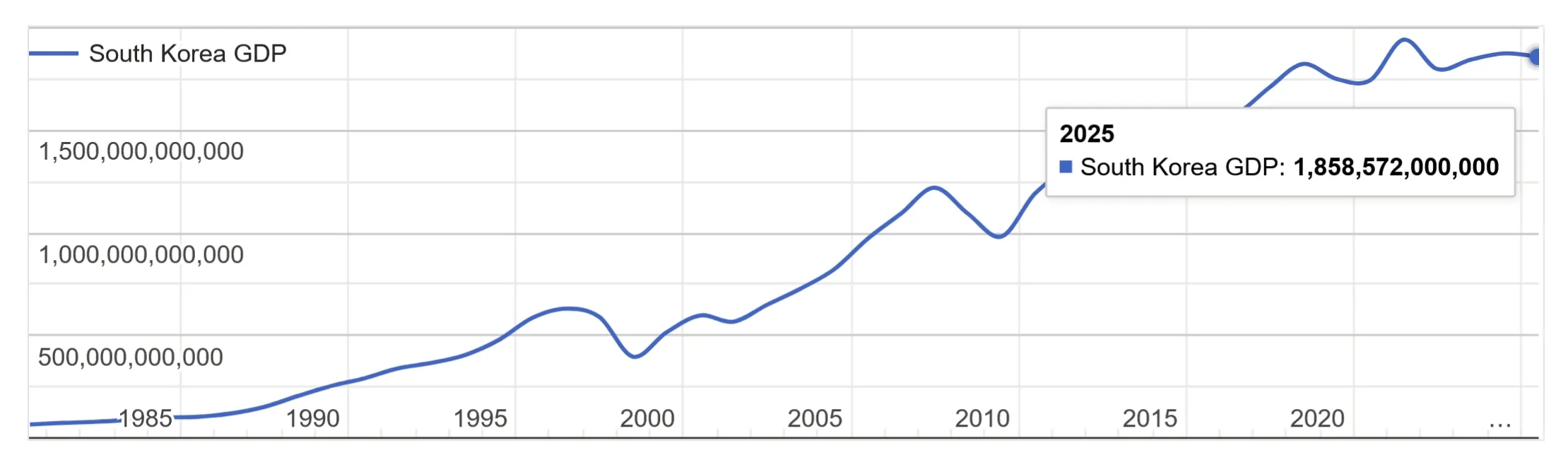

The reported 5% cap is also a simple way to frame the size question. For a listed company, 5% of equity is not a trading desk mandate. It is a board-level allocation that competes with buybacks, capex, and cash reserves. South Korea’s economy is above $1.85 trillion in GDP, according to the World Bank, so even small corporate allocations can translate into sizable onshore demand across the crypto market if access widens.

If the reported limits hold, the 5% cap and the top-20 filter act as guardrails. They reduce the odds that a corporate treasury position becomes a concentrated bet on illiquid assets, and they also narrow which tokens can attract corporate demand through the domestic listing gate.

The FSC has been building this step-by-step. In a May 2025 Virtual Asset Committee update, regulators said they would begin allowing certain entities like nonprofits and exchanges to sell crypto under finalized guidelines and that they were also working toward a plan for issuing real-name accounts to listed firms and corporate professional investors later in the year (FSC).

This shift is also arriving as traditional market infrastructure keeps testing token rails. DTCC has said it plans to tokenize a subset of DTC-custodied U.S. Treasuries on the Canton Network, which we covered in DTCC’s Quadrillions Move Toward Onchain Treasuries on Canton Network. JPMorgan Asset Management has also launched a tokenized money market fund on Ethereum, a structure we covered in JPMorgan’s $4T Asset Manager Launches a Tokenized Money Market Fund on Ethereum.

Key details were not disclosed in the reporting, including how frequently the top-20 list would be recalculated, how stablecoins would be treated, and what disclosure or audit requirements would apply to public companies that build token positions.

Regulators are also debating which agency should oversee stablecoin reserves and who should be allowed to issue won-pegged stablecoins under the next phase of South Korea’s rules, according to crypto.news.

For markets, the near-term question is operational rather than directional. Watch for the final guideline text, bank account issuance rules, and any disclosure standards for listed firms before concluding how large corporate flows could become.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | FSC press release (Feb. 13, 2025): Corporate participation roadmap for the virtual asset market |

| | FSC attachment (Feb. 2025): Roadmap for corporate participation in the virtual asset market (PDF) |

| | Seoul Economic Daily (Jan. 12, 2026): report on FSC corporate crypto guidelines |

| | CoinGecko: crypto market data |

| | Coinbase Exchange API - BTC-USD candles (1h, 12h window) |

| | World Bank: South Korea GDP data |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What changed in South Korea’s corporate crypto rules?

The FSC is drafting guidelines that would let listed firms and corporate professional investors trade crypto again under a 5% of equity cap, based on local reporting. The final guideline text has not been released.

What does the 5% equity cap mean for listed firms?

It limits the size of crypto holdings relative to a company’s equity, which keeps allocations small compared with buybacks, capex, and cash reserves. The cap applies to the amount a firm can allocate if the reported framework is adopted.

Which tokens would be allowed under the draft?

The reported draft limits purchases to the top 20 cryptocurrencies by market cap listed on South Korea’s major exchanges. How the list is calculated and updated was not disclosed.

What is a corporate real-name account in South Korea?

It is a bank-issued account tied to a verified corporate identity that connects fiat rails to exchange trading. Without it, a firm cannot easily trade on domestic exchanges.