NEW YORK, Jan. 26, 2026

Crypto investment products recorded about $1.73 billion of net outflows last week, led by U.S.-listed vehicles and heavy withdrawals from bitcoin and ethereum exposures, according to CoinShares.

Exchange-traded products are one of the fastest ways for large allocators to reduce crypto exposure without trading on exchanges, and that can tighten or loosen spot-market demand in a short window.

CoinShares head of research James Butterfill said the move reflected a shift in rate expectations, saying “dwindling expectations for interest rate cuts, coupled with negative price momentum, likely drove the outflows,” in comments reported by Cointelegraph.

Market snapshot: bitcoin traded around $87,900 on Monday and ether near $2,900, while CoinShares said total assets under management fell to about $178 billion from about $193 billion during the outflow week.

CoinShares: $1.73B leaves crypto ETPs in one week

CoinShares said U.S.-led products dominated the weekly withdrawals, with the U.S. accounting for about $1.8 billion of outflows, while several other regions saw smaller moves in either direction.

By asset, CoinShares said bitcoin products lost about $1.09 billion and ethereum products lost about $630 million over the week. Solana products drew about $17.1 million of inflows, while other assets were smaller and were not the driver of the headline number.

Some traders pointed to fresh on-chain alerts from Onchain Lens showing wallets labeled as BlackRock transferring about 1,815 BTC (about $159.4 million) and 15,112 ETH (about $43.8 million) to Coinbase Prime today, framing the move as continued selling pressure.

Issuer-level numbers put BlackRock at the center of the week’s flow prints. CoinShares said BlackRock’s iShares exchange-traded products accounted for about $951 million of the outflows, more than any other issuer tracked in the report.

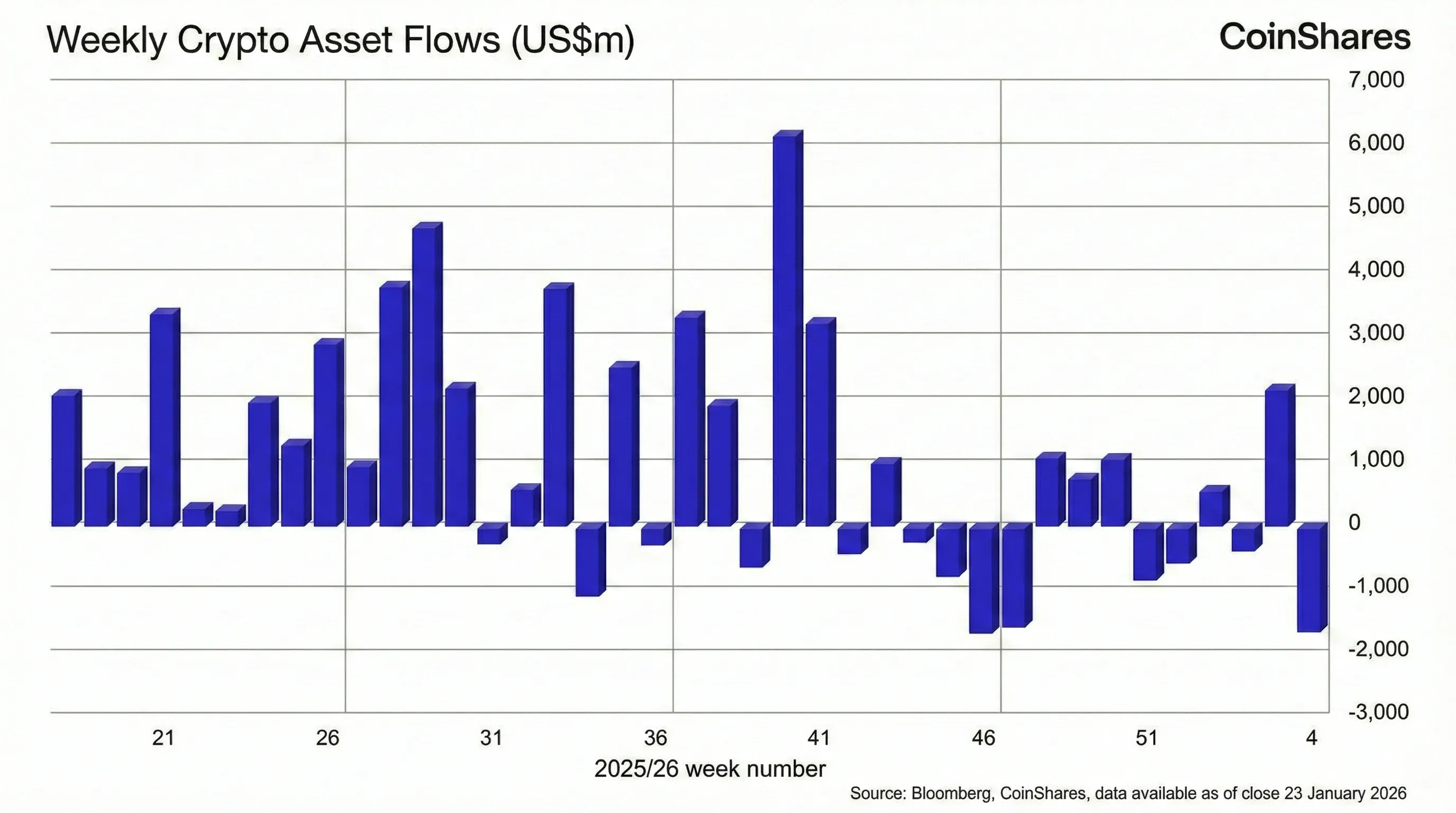

CoinShares’ weekly breakdown chart below shows how the flow pressure concentrated in bitcoin and ethereum products over the period covered by the report.

Weekly crypto asset flows by asset, from CoinShares’ weekly fund flows report.

The week followed a run where U.S. spot bitcoin ETFs flipped from outflows to inflows in mid-January. For a recent example of how quickly the tape can turn when creations resume, see our coverage of the three-session rebound in $1.7B Bitcoin ETF Inflows in 3 Days.

The flow split points to a simple mechanic. When risk budgets tighten, allocators often cut the largest, most liquid wrappers first. That does not prove broad capitulation, yet it shows where the market can shed exposure with the least friction.

U.S. spot bitcoin ETFs: $1.33B outflows through Jan. 23

Daily ETF flow tallies showed selling pressure concentrated in U.S. spot bitcoin ETFs through Friday, Jan. 23, in a four-session week shortened by the Martin Luther King Jr. Day holiday. Trackers such as SoSoValue and Farside Investors publish the daily creations and redemptions by fund.

On the final session of that week, U.S. spot bitcoin ETFs posted about $100 million of net outflows, and BlackRock’s IBIT accounted for most of that total, based on widely followed ETF flow trackers.

Weekly totals varied by tracker methodology and cutoffs, yet the broad read was consistent across dashboards and media summaries: net redemptions were the defining feature through Jan. 23, and IBIT was one of the biggest swing factors on the days it printed large outflows.

Those outflows are often described online as “BlackRock selling bitcoin.” In practice, many of these moves reflect how spot ETFs are built. Shares are created and redeemed through authorized participants, and the resulting inventory can move between custodians and prime brokers without any issuer describing the trade path in public.

For readers who want a concrete example of why the word “sold” can be misleading in ETF coverage, our earlier breakdown in BlackRock ‘Sold’ $251M Bitcoin: What IBIT Holdings Show walks through how a holdings change can line up with redemptions without proving an open-market sale.

The implication for market structure is narrow but important. Heavy redemptions remove a steady bid that had helped absorb supply during calmer weeks, and they can concentrate liquidity needs into a small set of trading windows where authorized participants manage inventory.

BlackRock, Coinbase Prime transfers, and the rates backdrop

As the flow pressure built, on-chain watchers tracked coins moving into institutional plumbing that sits behind many ETFs. A Jan. 21 note from ChainCatcher said wallets labeled as BlackRock’s iShares funds transferred about 635 BTC and 30,827 ETH to Coinbase Prime, citing Onchain Lens data.

Coinbase Prime is used by many institutions for custody and execution, and wallet transfers alone do not identify a buyer, a seller, or a motive. BlackRock does not publish real-time trade details around creations, redemptions, or rebalances, so it was not immediately clear which counterparties or orders were tied to the transfers flagged by on-chain trackers.

The combination of large daily outflows and prime-broker transfers is one reason manipulation narratives resurface in weak markets. A cleaner read is that ETF plumbing is visible on-chain while the decision-making is not, leaving room for people to fill gaps with intent. Our December look at recurring timing claims is in Bitcoin Manipulation? Who is Accumulating While Traders Are Getting Liquidated?.

Macro stayed in the frame for allocators building the weekly flows. The Federal Reserve’s next scheduled policy meeting runs Jan. 27 to Jan. 28, with the decision due Jan. 28, based on the Fed’s FOMC calendar. A policy path that looks higher-for-longer can raise the bar for risk exposure across portfolios, and crypto funds tend to reflect that quickly through redemptions.

What to watch next is concrete. Daily ETF flow prints will show whether the redemptions persist, and the next CoinShares weekly report will show whether the pressure is still concentrated in bitcoin and ethereum products or spreads. For more background on how fast large flow days can stack into larger weekly totals, our earlier coverage of IBIT’s December drawdowns is in BlackRock ETF IBIT Moves $200M in Bitcoin: Red Flag or Buy-the-Dip?.

The key unknown is who is behind the outflows and whether the withdrawals represent a temporary risk cut or a longer reallocation, since daily dashboards do not identify the end investors. The next few U.S. trading sessions, plus the Jan. 28 Fed decision, will be the near-term checkpoints for whether flows stabilize or extend.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | CoinShares: Research data (Fund Flows) |

| | Cointelegraph: CoinShares data on $1.73B weekly outflows |

| | SoSoValue: spot Bitcoin ETF dashboard |

| | Farside Investors: Bitcoin ETF flows |

| | Federal Reserve: FOMC calendars |

| | CoinGecko: Bitcoin price |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What does $1.73B of crypto outflows mean?

It refers to net redemptions from crypto exchange-traded products and funds tracked in the CoinShares weekly report, where more money moved out than in over the week.

Does an ETF outflow mean bitcoin was sold on the open market?

Not always. In a spot ETF structure, shares can be redeemed and inventory can move between custodians and prime brokers as part of creations and redemptions. Daily flow totals do not disclose counterparties or execution venues.

What is IBIT?

IBIT is BlackRock’s U.S.-listed spot bitcoin ETF. It issues and redeems shares through authorized participants, which is why its daily flow prints can swing with investor demand.

Why did Solana products see inflows when bitcoin and ethereum saw outflows?

The CoinShares report cited Solana inflows in the same week as bitcoin and ethereum outflows. The report does not provide investor-level reasons for each product’s flows.

What should readers watch next?

Watch the next published ETF flow prints, the next CoinShares weekly fund flows update, and near-term macro events like the Federal Reserve’s late-January 2026 meeting.