NEW YORK, Dec. 22, 2025

Midnight’s NIGHT token rose sharply over the past week, and one detail stood out in the trading data: Tickers showed most reported spot volume is tied to Bybit.

As of Dec. 22, CoinGecko data showed NIGHT up about 64% over seven days and up about 9% over 24 hours, trading near $0.10 with roughly $6.9 billion in 24-hour volume.

That concentration is not, by itself, proof that a single venue is “pumping” a token. It does raise verification questions about liquidity, incentives, and which on-chain representation traders are actually buying.

Daily Crypto Briefs reviewed CoinGecko tickers, chain explorers, and the project’s public repositories to map what is clear and what is not.

In December, price moves have repeatedly clustered around thin liquidity and crowded positioning, a dynamic we covered in Bitcoin’s $4,000 Flash Crash Wasn’t Retail: The Outflow Trail Behind the Liquidations and Bitcoin Manipulation? Who is Accumulating While Traders Are Getting Liquidated?.

What happened to NIGHT

The move came with large reported volume

CoinGecko data showed NIGHT with a market cap around $1.7 billion and fully diluted valuation around $2.5 billion at the time of writing.

CoinGecko also showed 24-hour volume around $6.9 billion, a volume-to-market cap ratio near 4 to 1, which is unusually high for many large-cap tokens.

Bitcoin and ether were both up about 2% to 3% over 24 hours in the same CoinGecko snapshot, but NIGHT’s move was larger.

The Bybit question

CoinGecko tickers showed extreme venue concentration

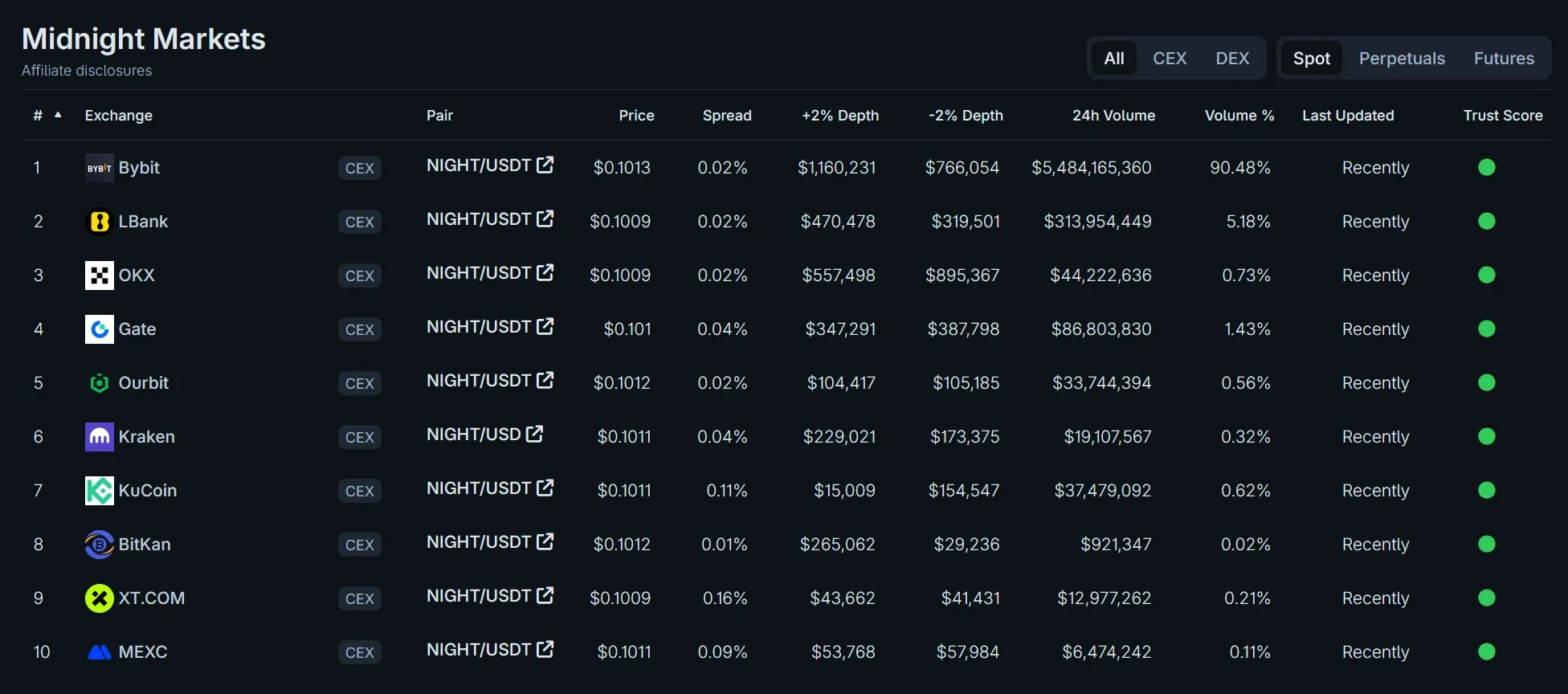

Tickers showed Bybit as the dominant spot venue for NIGHT, representing about 90% of reported volume in the dataset at the time of writing.

Screenshot: CoinGecko tickers for NIGHT, showing Bybit listed at the top by reported volume.

A single-venue footprint can mean many things, from genuine demand concentrated on the deepest order book to incentives that pull activity into one market.

The tickers alone do not show who placed the trades, whether flows were organic, or whether any activity was wash trading.

The Bybit prize pool campaign

Bybit’s official account said on Dec. 9 that $NIGHT was listed on its spot market and promoted a 200,000,000 NIGHT prize pool tied to trading and deposits.

The Midnight account also circulated Bybit’s listing post, based on its public feed.

Prize pools and similar exchange campaigns can concentrate volume on one venue, especially early in a token’s public trading history.

Spot pairs for NIGHT are also listed on other venues including OKX, Gate, KuCoin and Kraken, but ByBit was by far the one driving the token price. So now the question is, is this really a project worth investing in?

To answer this question, we need to dive deep into the fundamuntals.

What is Midnight?

Midnight describes itself as a privacy-focused blockchain that aims to let users prove facts about data without revealing the data itself, using zero-knowledge proofs, according to the project’s public code and documentation in the midnight-node repository.

For everyday traders, the key point is that “privacy” can mean more than hiding balances. It also means proving compliance or eligibility without sharing raw user information.

A token distribution program that describes staged claims

A GitHub repository maintained under the project’s organization describes a NIGHT distribution program called the “Midnight Glacier Drop,” with phases for claiming tokens and later redeeming them, with tokens described as “frozen” until a later stage.

The red flags and open questions

The BNB Chain contract is owner-controlled, based on the verified code view

BscScan’s contract page for the BNB Chain token contract shows verified source code for a contract that inherits an ownership pattern and includes mint and update functions in the published interface.

BscScan’s token tracker also labels the token’s profile data as unverified, and its address page displayed a “No Contract Security Audit Submitted” label for the verified contract at the time of writing.

Owner-controlled minting can be part of a bridge design, but it also creates reliance on key management and on whatever off-chain policies govern issuance.

Contract security checks red flags

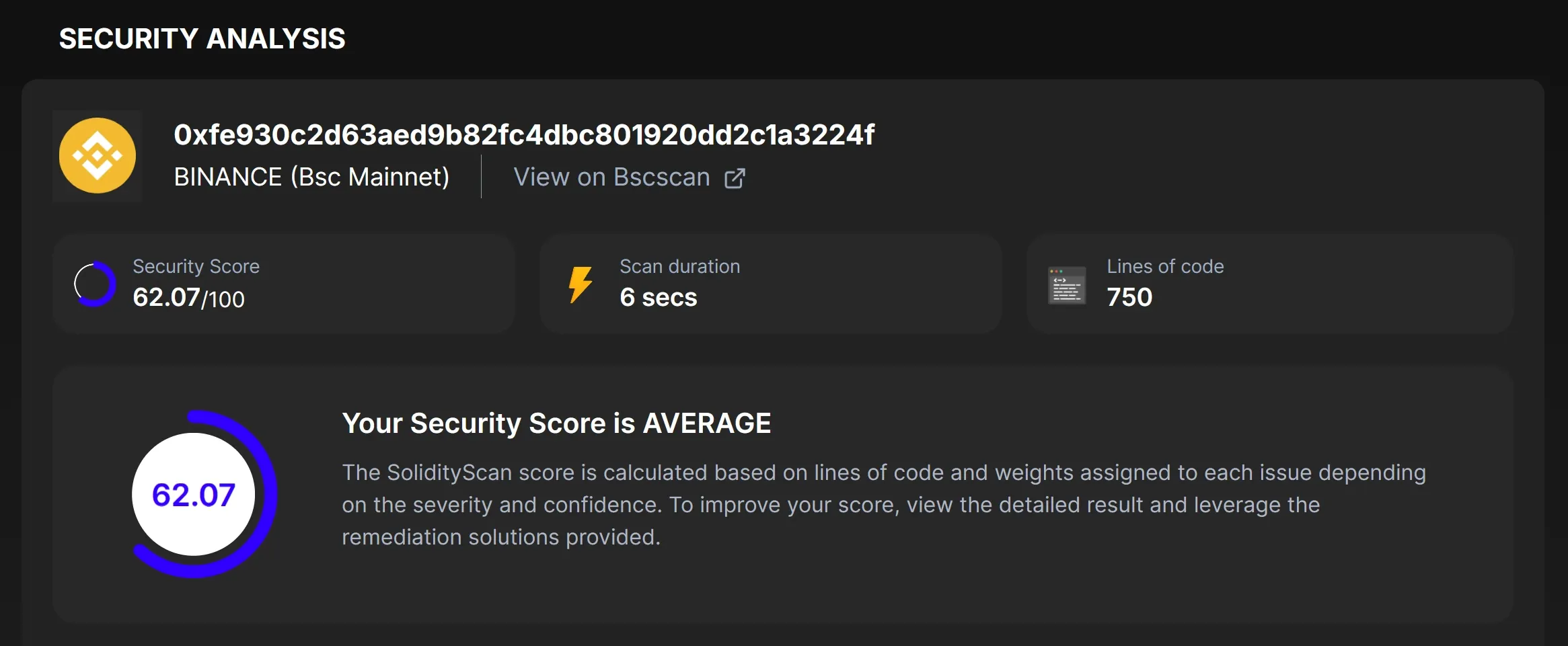

Daily Crypto Briefs reviewed the BNB Chain contract’s verified code view on BscScan and an automated SolidityScan report shared with our newsroom.

The key issues flagged line up with what traders usually watch in early-stage tokens.

Screenshot: SolidityScan security assessment highlights for the NIGHT BNB Chain contract.

One is supply control. The contract includes owner-only mint and burn functions, which means one admin key can increase or decrease supply on that representation.

Another is ownership. The SolidityScan report flagged that ownership was not renounced and listed an owner address, which is consistent with an owner-controlled token design.

That can be normal for wrapped or bridged tokens, yet it also means holders are trusting off-chain governance and key security.

The report also flagged an ERC20 approve race condition as a low-risk issue. This is a known allowance pattern where a spender can front-run an approval change under certain conditions.

The BscScan code view shows the contract includes increaseAllowance and decreaseAllowance functions, which are commonly used to reduce that risk.

The report also flagged concentration risk, saying some addresses hold more than 20% of circulating supply and listing two addresses with large percentages.

Daily Crypto Briefs could not independently verify holder concentration from BscScan exports at the time of writing because the export endpoint returned a bot protection page.

These red flags describe a token contract shape that can fail fast if admin keys are compromised, if supply controls are used aggressively, or if large holders decide to exit into thin order books.

The technical pitch does not match the token wrapper

Midnight’s public messaging focuses on privacy, selective disclosure, and zero-knowledge proofs. But the BNB Chain representation linked in the listing looks like a basic wrapped token contract with owner-only supply controls and a legacy Solidity compiler range.

This means you should treat token price action and exchange incentives as separate from claims about the underlying privacy chain until the project publishes a clear bridge and supply model for each representation.

The public trading history is still short

Data points to a short window of public price history, which started on december 9th of 2025.

On BNB Chain, BscScan shows the token contract was created on Dec. 4, 2025, based on the contract creation transaction. So clearly the project is still new and we have yet to see how it eveolves, and whether or not promises will be kept.

What to watch next

Whether volume disperses beyond a single venue

If the rally is supported by broad participation, volume may spread across venues over time.

If it stays concentrated on ByBit, the market may be treated as more vulnerable to large prints that can widen spreads quickly.

Be careful of social impersonators

The project’s Twitter handle is @MidnightNtwrk. We reviewed multiple separate X account shared by readers that uses a similar name. These accounts did not present clear, verifiable links back to Midnight’s official sites in the public profile data available.

In fast markets, lookalike accounts are a common vector for engagement farming and scam links, so please if you decide to participate, you should verify handles against official listings before interacting.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | CoinGecko Midnight listing market data and tickers |

| | X: Bybit announces NIGHT listing and prize pool (Dec. 9, 2025) |

| | X: Midnight account page |

| | CoinGecko API: search results for “midnight” |

| | BscScan: NIGHT token contract on BNB Chain |

| | BscScan: Contract creation transaction for the BNB Chain token |

| | GitHub: Midnight NIGHT token distribution repository |

| | GitHub: Midnight node repository |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What is the Midnight NIGHT token?

NIGHT is the token tied to Midnight, a privacy-focused blockchain project. CoinGecko lists NIGHT with both Cardano and BNB Chain token identifiers, which suggests more than one on-chain representation.

Is the NIGHT rally tied to an announcement?

No specific catalyst was confirmed in the sources reviewed for this report. CoinGecko tickers showed heavy volume concentration on one venue, which can move price even without a new headline.

What is NIGHT token max supply?

CoinGecko lists 24 billion as max supply and about 16.6 billion as circulating supply for NIGHT.

How do I avoid buying the wrong Midnight token?

CoinGecko search results show multiple tokens named “Midnight” with the symbol NIGHT across different chains. Check the contract address or on-chain identifier on the exchange and match it to an explorer link from a trusted listing.