NEW YORK, Jan. 30, 2026

Bitcoin fell below $82,000 today, Jan. 30, as a sharp derivatives-driven selloff pushed 24-hour liquidations toward $1.7 billion and drove the Crypto Fear & Greed Index down to 16, a level labeled “Extreme Fear,” as investors weighed whether the selloff is a temporary “discount” or the start of a deeper drawdown.

A fast move lower forced leveraged traders to close positions, which amplified declines in a feedback loop. The question now is less like “where is the bottom” and more whether a rules-based accumulation plan can be executed through stress.

Bitcoin slips below $82K as liquidations hit leveraged longs

Market snapshot: Data showed bitcoin trading around $81,900 with a 24-hour low near $81,071. 24-hour crypto liquidations reached around $1.74 billion as Crypto Fear & Greed Index printed 16.

The index reading is not a timing tool by itself, but it tends to capture the moments when investors are least comfortable buying.

The market has been leaning on the November high/low range as the key reference zone, and the drawdown fits the timing of bitcoin’s loosely observed four-year cadence.

Bitcoin’s four-year cadence, shown as a reference framework rather than a timing signal.

The same technical playbook highlights a potential retest of the April 2025 lows around $75,000 if support does not hold, though that pathway depends on liquidity conditions rather than a calendar.

For readers who don’t trade derivatives: a “liquidation” is what happens when a leveraged position runs out of collateral and the exchange closes it automatically. When many long positions are liquidated at once, those forced market orders can deepen a down move even if spot demand is steady.

The six-month snapshot below shows bitcoin is down about 26% versus early August 2025 levels, a simple way to quantify what “discounted” means without turning it into a prediction.

Fear & Greed Index prints 16 as discounted-entry talk returns

The Crypto Fear & Greed Index printed 16 on Jan. 30, a reading the index labels Extreme Fear, according to Alternative.me’s dashboard.

One way long-term allocators respond to this kind of volatility is by shifting from “timing” to process. Dollar-cost averaging, buying a fixed amount on a fixed schedule, exists for markets where the next dip is not only possible but common, and it can help investors stick with a plan if the “discount” deepens after the first bounce.

We previously broke down a concrete framework and common mistakes traders make when dollar-cost averaging.

Institutional “plumbing” is also still getting built in the background, which matters more for medium-term liquidity than intraday candles. In Washington, policy timelines remain fluid, see our coverage of the U.S. Senate CLARITY Act vote being canceled, while regulators and plan sponsors continue to debate mainstream access routes like retirement accounts, including the push described in SEC Chair Paul Atkins’ comments on opening the $12.5T 401(k) market to crypto.

Key Bitcoin levels: November range, $83.5K value low, and $87.2K reclaim

Price action has continued to respect prior inflection zones, particularly the November high/low range that has acted as a reference band for both support and resistance during this leg lower, based on Daily Crypto Briefs’ market profile work.

On a monthly “market profile” view, an auction-market framework that highlights where trading activity clustered, bitcoin traded through the two-month composite value low in the $83,500 area overnight. Acceptance below a prior value area can increase the odds of follow-through, while failed acceptance can set up a sharp snap-back if buyers step in aggressively.

Immediate resistance sits near $84,000, with a stronger overhead band around $86,000 tied to “single prints,” a market-profile term for thinly traded zones that often act like air pockets on revisits.

Chart of the weekly market profile levels described above.

On the weekly profile, previously formed “poor lows” from the prior rotation higher have now been traded, a sign that earlier stop clusters have been cleared and that the market is searching for fresh areas of two-way trade rather than simply defending old pivots.

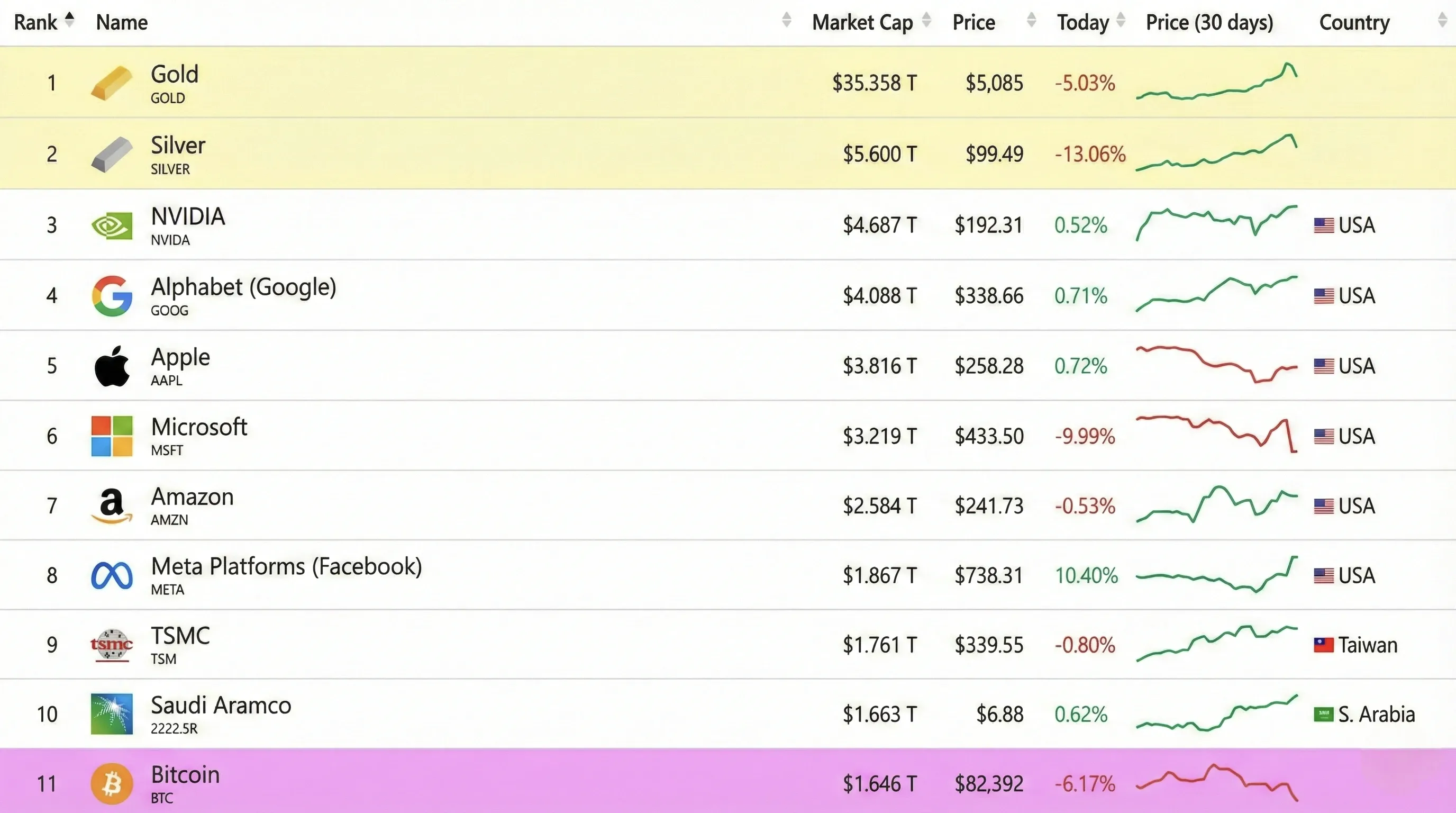

In the same risk-off context, bitcoin’s market-cap rank has become a headline again. Some trackers have recently shown bitcoin briefly moving around the global top-10 cutoff by market value, depending on the ranking methodology and the day’s closing prices, including CompaniesMarketCap’s assets-by-market-cap tables.

Chart of a top-10 assets-by-market-cap ranking.

What matters operationally is not the ranking itself, but the signal behind it: if bitcoin’s price declines faster than other mega-cap assets, it can change who controls marginal liquidity in portfolio rebalancing flows.

For now, traders are watching whether bitcoin can quickly reclaim $87,200; if it does not, some technical models point to a path where the next visible liquidity sits closer to the $75,000 area, a level that also lines up with prior-cycle drawdown zones referenced in April 2025 trading.

Moves like this matter because they can reset leverage, widen bid-ask spreads, and change who sets the marginal price, at least temporarily. They can also test institutional products and custody rails under stress, which is where liquidity and confidence can diverge quickly.

The next leg will likely be shaped by whether forced selling is truly finished and whether spot flows stabilize. Watch the next daily U.S. spot bitcoin ETF flow prints, funding-rate and open-interest resets on major venues, and upcoming macro catalysts such as U.S. inflation releases and Federal Reserve messaging, which can shift risk appetite quickly.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | Alternative.me: Crypto Fear & Greed Index |

| | CoinMarketCap: Bitcoin (BTC) |

| | CoinGecko: Bitcoin (BTC) |

| | CompaniesMarketCap: Assets by market cap |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What does Fear & Greed Index 16 mean for bitcoin?

A 16 reading is labeled “Extreme Fear,” indicating stressed sentiment and elevated volatility. It is not a standalone buy or sell signal.

Why do liquidations matter when bitcoin sells off?

Liquidations are forced closes of leveraged positions. When many longs are liquidated, automatic market orders can accelerate a drop even if spot demand is unchanged.

Is bitcoin “discounted” below \$82,000?

“Discounted” is a narrative, but the math is clear: bitcoin is meaningfully below its levels from the prior six months. Whether that becomes value depends on time horizon and risk controls.

What is dollar-cost averaging (DCA) in crypto?

DCA means buying a fixed amount on a fixed schedule to reduce the pressure of timing entries. It is commonly used to accumulate through volatile drawdowns.

What levels are traders watching after bitcoin broke \$82,000?

Daily Crypto Briefs is watching the \$83,500 value area, resistance near \$84,000–\$86,000, and a potential reclaim level around \$87,200. Some technicians also flag \$75,000 as a downside liquidity zone if support fails.

What should investors watch next?

Watch whether liquidations fade, whether funding and open interest reset, and whether spot demand stabilizes. Near-term catalysts include ETF flow reports and macro releases that move risk appetite.