WASHINGTON, January 20, 2026

SEC Chair Paul Atkins said Congress is close to passing a crypto market structure bill clarifying the SEC and CFTC split, as bitcoin traded near $89,470 and fell about 3.8% over the past 24 hours.

Atkins is signaling that Washington is moving from court fights to written rules for how crypto is issued, traded, and supervised in the U.S., even as price action shows traders are not treating the comments as a near-term catalyst.

Market data from CoinGecko showed bitcoin down about 3.8% over 24 hours with estimated spot volume near $57.1 billion, while ether fell about 6.8% and bitcoin’s market-cap dominance hovered around 57.6%.

Atkins said: “I am wholly supportive of Congress providing clarity on the jurisdictional split between the SEC and the @CFTC.”

The push builds on the House’s Digital Asset Market Clarity Act of 2025, known as the CLARITY Act, which was introduced on May 29, 2025 and advanced out of the House Financial Services and Agriculture committees on June 10, 2025, according to a House Financial Services one-pager.

CLARITY Act and the SEC vs CFTC split now in play

The CLARITY Act frames the market structure problem as a sorting issue. When a token trades like a fundraising contract, it sits closer to securities law and the SEC’s disclosure regime. When a token trades like a commodity-style spot asset, it sits closer to trading rules that lawmakers want the CFTC to oversee.

The House summary says the goal is to give developers a defined path to raise funds under the SEC’s umbrella, while giving customer-facing firms a registration route to serve users in digital asset markets. It also sketches baseline guardrails like disclosures, segregation of customer assets, and conflict controls, a set of requirements that tends to matter more to risk teams than headline labels.

The split is important for big pools of capital that cannot tolerate shifting legal labels. A clear pathway can lower the compliance friction that keeps many large firms from scaling exposure beyond a small allocation, even when they are comfortable with the market risk.

The bill is still moving through the political calendar, and a final vote timetable was not immediately clear. Our previous coverage has walked through the mechanics of H.R. 3633 in CLARITY Act: H.R. 3633 and the crypto market structure fight and the stop-start cadence around the canceled Senate vote.

The current House text is published on Congress.gov, and changes between drafts are often where the real risk sits for exchanges, brokers, and custody firms.

Strategy’s $2.13B bitcoin buy shows how treasuries react to policy signals

While the market structure debate focuses on rules, corporate balance sheets are already acting on the assumption that bitcoin can sit inside a compliant treasury strategy, a playbook many investors still shorthand as the MicroStrategy trade.

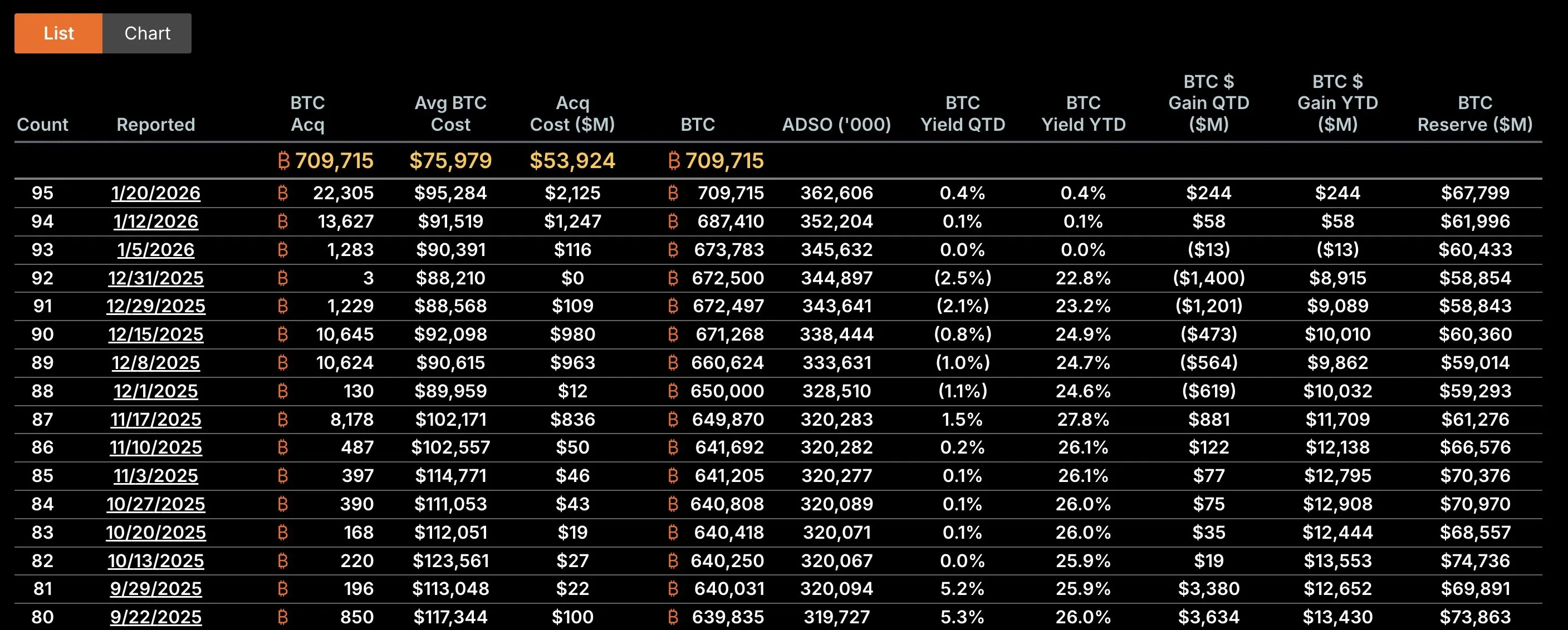

In a Form 8-K filing, Strategy said it acquired 22,305 bitcoin for an aggregate purchase price of about $2.13 billion between Jan. 12 and Jan. 19, and reported total holdings of 709,715 BTC as of Jan. 19. The company said the purchases were funded through share sales under its at-the-market programs.

MicroStrategy Bitcoin Holding as of Jan. 19, 2026: 709,715 BTC

An at-the-market program lets a public company sell new shares over time and deploy the proceeds according to its stated plan.

The same filing put the average purchase price for that week’s buys at $95,284 per bitcoin, including fees and expenses. It also disclosed an aggregate purchase price of about $53.92 billion for its total bitcoin position and an average purchase price of $75,979 per bitcoin, figures that matter because they shape how the company’s results move with the market.

If lawmakers lock in a durable SEC and CFTC split and trading venues get a clearer registration path, the result can be a lower hurdle rate for firms that want exposure but need clean compliance narratives for boards, auditors, and risk committees.

Stablecoins, bank pressure, and the regulatory discount in bitcoin

Market structure legislation does not set bitcoin’s price. It changes how investors model legal risk, custody risk, and venue risk, which often gets priced as a discount during periods of regulatory uncertainty.

Stablecoins are part of that model because they act like settlement cash for both centralized exchanges and on-chain trading. A stablecoin is a token designed to track one U.S. dollar, and when dollar tokens can move 24 hours a day, they compete directly with bank deposits as the default place to park cash between trades, especially if issuers are allowed to share yield with holders.

Yield-bearing stablecoins are a flash point in that competition. If a dollar token pays a return, it can feel like a money-market-style product inside a wallet, which puts pressure on banks that rely on deposits as their lowest-cost funding source.

Banks have pushed to keep yield inside traditional products, and lawmakers have treated stablecoin rules as a separate but linked track. We broke down that tension in Banks Are Coming for the Stablecoin Market, and the stablecoin lane in The GENIUS Act and the Stablecoin Market.

At a policy level, the key is not slogans. The closer Congress gets to writing clear lines, the less crypto trading depends on guessing how regulators will apply decades-old securities tests to new market plumbing. Our longer-run framework for how that plays out through 2026 is in US Crypto Regulation 2026: SEC, CFTC, Stablecoins, Taxes.

A final legislative schedule was not disclosed, and it was not immediately clear what amendments could still alter the SEC and CFTC lines. Next catalysts to watch include the release of any updated bill text, confirmed vote timing, and the first wave of agency rule proposals that would translate the framework into operating requirements for exchanges, brokers, custodians, and stablecoin-linked rails, a process that can still stretch into 2026.

Stay up to date

Get the latest crypto insights delivered to your inbox

Primary sources and further reading

| Source | Title |

|---|---|

| | Paul Atkins post on SEC vs CFTC split (Jan. 12, 2026) |

| | Congress.gov: H.R. 3633 text (CLARITY Act) |

| | House Financial Services: CLARITY Act one-pager (July 10, 2025) |

| | SEC EDGAR: Strategy Inc Form 8-K (bitcoin purchases and holdings) |

| | CoinGecko: Bitcoin price, volume, and market data |

Fact-checked by: Daily Crypto Briefs Fact-Check Desk

Frequently Asked Questions

What is a crypto market structure bill?

It is legislation that defines which agencies regulate different parts of crypto trading, sets registration paths for firms, and clarifies when a token is treated as a security versus a commodity-style digital asset.

What does the SEC vs CFTC split mean for traders?

A clearer split can reduce the risk that a venue or token is reclassified after launch, which can affect listings, custody rules, and what compliance checks brokers and exchanges must run.

What is stablecoin yield and why do banks care?

Stablecoin yield is when a dollar token pays a return to holders. Banks often treat that as direct competition with deposits and money market products, since it can pull cash away from traditional accounts.